Top Guidelines Of Eb5 Immigrant Investor Program

The Buzz on Eb5 Immigrant Investor Program

Table of ContentsFacts About Eb5 Immigrant Investor Program RevealedEb5 Immigrant Investor Program for DummiesThe Definitive Guide for Eb5 Immigrant Investor ProgramSome Known Details About Eb5 Immigrant Investor Program Eb5 Immigrant Investor Program Fundamentals ExplainedThe Main Principles Of Eb5 Immigrant Investor Program

Despite being less popular, various other pathways to acquiring a Portugal Golden Visa include investments in equity capital or private equity funds, existing or new service entities, capital transfers, and donations to support scientific, technical, creative and cultural developments. Owners of a Portuguese resident license can likewise work and research in the country without the requirement of getting extra licenses.

See This Report on Eb5 Immigrant Investor Program

Investors have to have both a successful business background and a substantial company record in order to apply. They might include their spouse and their youngsters under 21-years- old on their application for permanent house. Successful candidates will get an eco-friendly five-year reentry license, which permits open traveling in and out of Singapore.

A Biased View of Eb5 Immigrant Investor Program

Candidates can invest $400,000 in federal government approved genuine estate that is resalable after 5 years. Or they can spend $200,000 in government accepted real estate that is resalable after 7 years.

This is the primary benefit of immigrating to Switzerland contrasted to other high tax obligation countries. In order to be qualified for the program, applicants need to More than the age of 18 Not be utilized or occupied in Switzerland Not have Swiss citizenship, it should be their very first time living in Switzerland Have actually rented or bought home in Switzerland Provide a lengthy checklist of identification papers, including clean criminal document and great ethical character It takes around after repayment to get a resident permit.

Rate 1 visa owners remain in condition for concerning three years (depending upon where the application was submitted) and must put on expand their stay if they want to proceed living in the United Kingdom - EB5 Immigrant Investor Program. Prospects must have individual properties that worth at even more than 2 million and have 1 million of their very own cash in the U.K

The smart Trick of Eb5 Immigrant Investor Program That Nobody is Talking About

The Tier 1 (Business Owner) Visa is legitimate for three years and 4 months, with the alternative to expand the visa weblink for an additional 2 years. The applicant might bring their reliant relative. As soon as the entrepreneur has remained in the United Kingdom for 5 years, they can get indefinite leave to continue to be.

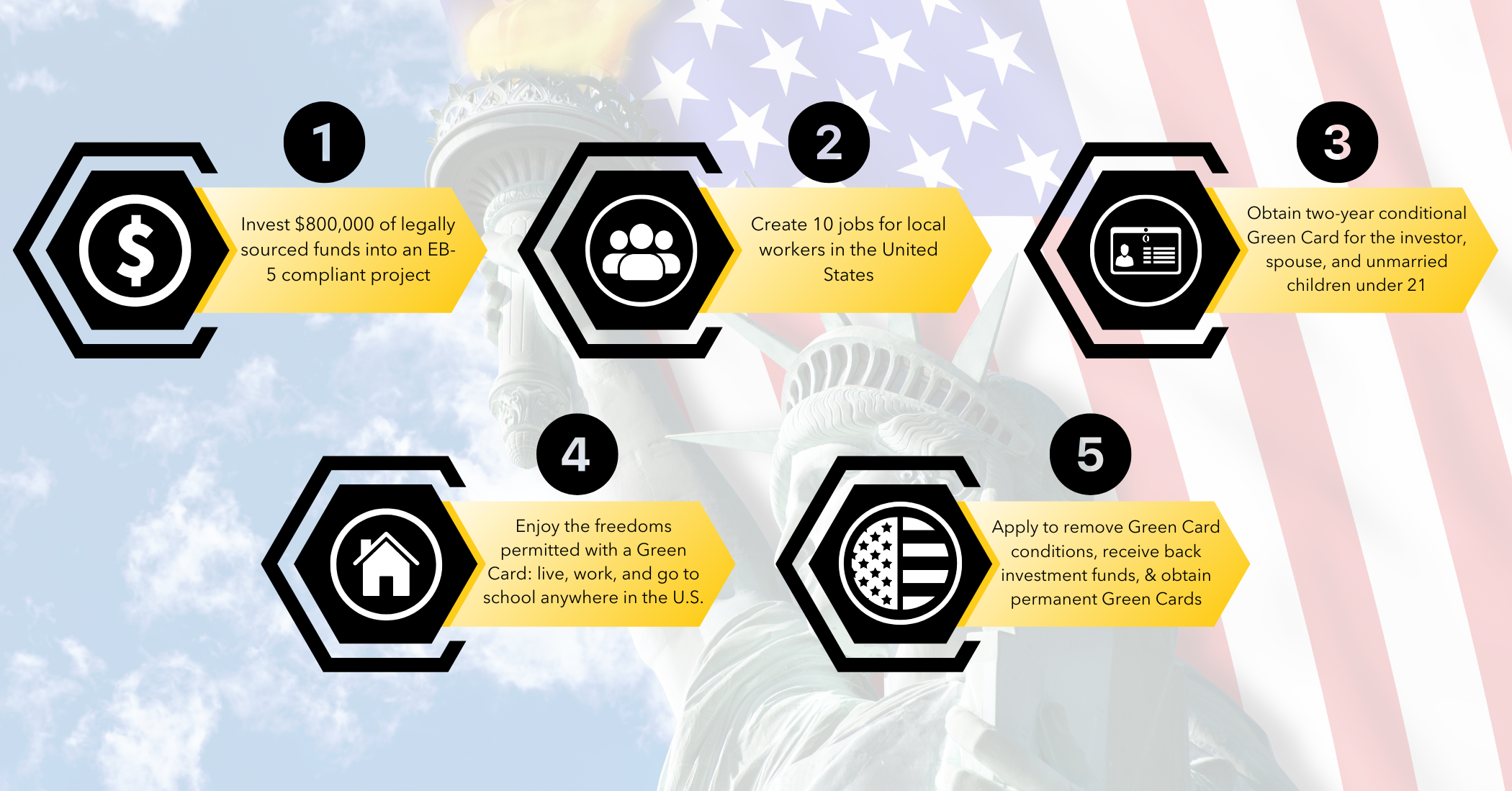

Investment migration has gotten on an upward trend for even more than two years. The Immigrant Financier Program, also referred to as the EB-5 Visa Program, was developed by the U.S. Congress in 1990 under the Migration Act of 1990 or IMMACT90. Its primary objective: to promote the U.S. economy with job production and capital expense by foreign financiers.

This consisted of reducing the minimum financial investment from $1 million to $500,000. Over time, adjustments have actually raised the minimum investment to $800,000 in TEAs and $1.05 million in other locations.

The 6-Minute Rule for Eb5 Immigrant Investor Program

Visas are "scheduled" each : 20% for country, 10% for high unemployment, and 2% for infrastructure. Unused reserves rollover to the following year. Programmers in backwoods, high joblessness locations, and facilities projects can benefit from a specialized swimming pool of visas. Investors targeting these particular areas have actually an enhanced chance of visa accessibility.

Developers working useful content on public works tasks can currently get EB-5 funding. Capitalists now have the chance to purchase government-backed infrastructure jobs. Particular USCIS analyses under previous law are secured by law, consisting of prohibited redemption and financial debt setups, and gifted and lent mutual fund. Developers require to ensure their financial investment plans comply with the brand-new statutory definitions that affect them under U.S.

migration regulation. EB5 Immigrant Investor Program. Financiers should be mindful of the accepted sorts of financial investment funds and arrangements. The RIA has actually established demands for concerns such as redeployment, unlike before in previous versions of the regulation. Investors and their family members already lawfully in the U.S. and eligible for a visa number might concurrently file applications for change of condition in addition to or while awaiting adjudication of the capitalist's I-526 request.

This simplifies the procedure for financiers already in the United state, quickening their capability to adjust status and staying clear of consular visa handling. Investors looking for a quicker handling time could be much more inclined to invest in country projects.

Unknown Facts About Eb5 Immigrant Investor Program

Seeking U.S. federal government info and solutions?

To certify, applicants need to invest in new or at-risk commercial enterprises and create full time settings for 10 certifying employees. The U.S. economic situation advantages view most when a location is at danger and the new investor can provide a working facility with complete time tasks.

TEAs were applied into the investor visa program to urge buying areas with the greatest demand. TEAs can be backwoods or locations that experience high joblessness. A backwoods is: outside of conventional city analytical locations (MSA), which is a city and the surrounding areas within the outer border of a city or town with a population of 20,000 or more A high unemployment location: has actually experienced joblessness of at the very least 150% of the national typical price An EB-5 local facility can be a public or private economic system that advertises financial development.